With the Swedish government revising its growth forecasts for 2011 lower in the budget presented Tuesday, citing the risk of slower growth developing in the eurozone as a result of fiscal austerity, there is a growing concern to see which way the Sweedish currency goes with almost 40% of Sweden’s exports heading to the eurozone is a rising concern. However, despite the prospect of slower exports to the eurozone, the government is still forecasting growth of 3.7% in 2011 and 3.4% in 2012. Although this is a downward revision from the earlier forecast of 4.0% growth for 2011, the pace of growth forecast by the Swedish government would still far outpace the anticipate growth in much of the developed world.

SEK Negatives: The Swedish government's latest budget has proposed SEK13bn of tax cuts and spending, experts feel that it they are in line with expectations and indications given ahead of the elections, but could very well prove insufficient to keep the economy on track if developments fail to meet the governments optimistic assumptions. Although Analysts at BNP Paribas feel that investors would still have to look to the emerging markets in Asia and Latin America to find a faster pace of growth as Swedish government estimates are on the optimistic side with BNP Paribas experts forecasting growth in Sweden of just 2.9% in 2011.

SEK Positives: Swedish data has been robust and better than the market had hoped for and Swedish rate expectations have risen accordingly. Despite the Fed moving towards further policy accommodation there is no concern at the Riksbank. Although there are rising concerns over the international environment and the level of the SEK, on the positive side, Riksbank’s survey of Swedish companies have revealed that that most corporations expect the economic climate to continue to improve over the next six months with a broad up turn in activity expected.

Amid all the negatives, experts continue to believe that there is still plenty of scope for the SEK to rally as Sweden continues to out perform its peers and the Riksbank looks to normalize momentary policy. Testimony to the fact is that the Swedish equity market has continued to outperform with the OMXC up 14.5% year-to-data (eurostox is currently down 6.4% year-to-date).

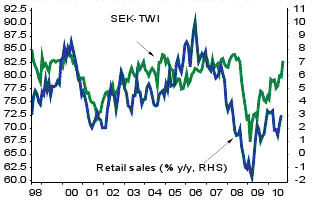

SEK TWI and Swedish Retail sales

Source: Reuters Ecowin Pro. The SEK is expected to extend gains as the Swedish economy is set to continue to out perform with the Riksbank maintaining its policy of normalizing monetary conditions. The SEK is still a long way from being overvalued on many measures, suggesting that concerns by some members of the Riksbank regarding the level of the SEK are unjustified.

SEK Projections: Analysts at BNP Paribas have recommended using any near-term EURSEK corrective rebound into the 9.32/9.34 area to establish renewed bearish strategies targeting the 8.90 area as NOKSEK is also set to extend the major down trend towards the 1.0970 area.

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

No comments:

Post a Comment