Most of the world currency markets is brimming with activity as speculation over QE2, G20, capital controls and inflation continues to be in the limelight today with the BOE and the FED grabbing most attention. Meanwhile Asian news suggesting currency reserves are also on the rise with the EU Head of State meeting where the German Chancellor is expected taking a non-compromising position while the BOJ bringing its policy meeting forward. Markets are generally softer, with the USD biased for strength.

There is also a market sentiment suggesting that China and the US are close to an agreement on current account imbalances pushing markets to curtail their expectation for QE2 as forex experts feel that the logic being that a softening in China’s stance would ease pressure on the US to implement QE2. Analysts at BNP Paribas meanwhile expect USD range trading today, but with US bonds yields staying bid for now USDJPY and EURJPY should rally, while EURUSD’s upside should be limited by 1.3920. GBPUSD remains a clear sell near 1.5800 after Posen's suggesting that QE might come too late and might be not enough.

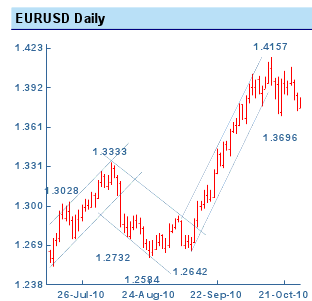

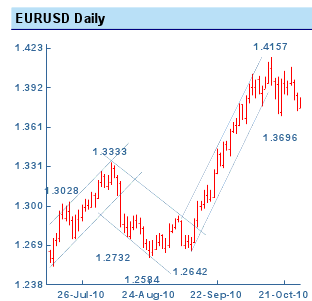

EUR-USD: The EUR has weakened since yesterdays close, but is still trading within its three-week 1.3698 to 1.4159 range. A break of this range should foreshadow the next move. Today the focus is on the USD rally driven by scaled back expectations of QE. Analysts at Scotia Capital have suggested that this will prove temporary and that the EUR will still face upward pressure into year-end on the back of a weak USD. However, for now the risk is that the market is extremely short the USD and shift in sentiment could see downside pressure on EUR as position squaring takes over.

USD- CAD: CAD is under performing today, having lost 0.4% against the USD and 0.2% against EUR. USDCAD is within a hundred points of the clustering of its 50, 100 and 200-day moving averages (1.0314, 1.0345 and 1.0344, respectively) and the year-to-date average trading level of 1.0345. All in all, USDCAD remains firmly within its year-to-date range, unable to break decidedly on either side of it. The main driver of USDCAD continues to be QE in the US and the odds of a currency agreement. With the PBoC hiking rates ahead of key data releases on Thursday, these odds improved. This thematic has already taken over. USDCAD around 1.0350 continues to offer opportunities to go short.

Asian Currencies: Asian currencies have come in firmer dragging G-10 currencies against the USD with it. Korea doubling its current account surplus from August to September and China allowing USDRMB to fix higher for the 4th consecutive day will bring the theme of Asian currency reserves and the related allocation issues back to the market. Meanwhile, the Bank of Japan is expected to downgrade its forecasts for the country's economic growth and prices at its policy meeting today amid signs that the return of the economy to a path of sustainable expansion will be delayed due to deflation.

AUD-USD: AUD is under performing having lost 1.3% against the USD and 1.1% against EUR. A softer than expected CPI release (coming in at 0.7% q/q and 2.8% y/y) has dampened the expectations for further interest rate increases and weighed on AUD. In some ways, the CPI release has simply offset the positive impact the currency and interest rate outlook received with the above consensus PPI release earlier this week. Governor Stevens recently indicated that monetary policy would have to take into account one off shocks to terms of trade on inflation over and above the regular cyclical factors.

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

There is also a market sentiment suggesting that China and the US are close to an agreement on current account imbalances pushing markets to curtail their expectation for QE2 as forex experts feel that the logic being that a softening in China’s stance would ease pressure on the US to implement QE2. Analysts at BNP Paribas meanwhile expect USD range trading today, but with US bonds yields staying bid for now USDJPY and EURJPY should rally, while EURUSD’s upside should be limited by 1.3920. GBPUSD remains a clear sell near 1.5800 after Posen's suggesting that QE might come too late and might be not enough.

EUR-USD: The EUR has weakened since yesterdays close, but is still trading within its three-week 1.3698 to 1.4159 range. A break of this range should foreshadow the next move. Today the focus is on the USD rally driven by scaled back expectations of QE. Analysts at Scotia Capital have suggested that this will prove temporary and that the EUR will still face upward pressure into year-end on the back of a weak USD. However, for now the risk is that the market is extremely short the USD and shift in sentiment could see downside pressure on EUR as position squaring takes over.

USD- CAD: CAD is under performing today, having lost 0.4% against the USD and 0.2% against EUR. USDCAD is within a hundred points of the clustering of its 50, 100 and 200-day moving averages (1.0314, 1.0345 and 1.0344, respectively) and the year-to-date average trading level of 1.0345. All in all, USDCAD remains firmly within its year-to-date range, unable to break decidedly on either side of it. The main driver of USDCAD continues to be QE in the US and the odds of a currency agreement. With the PBoC hiking rates ahead of key data releases on Thursday, these odds improved. This thematic has already taken over. USDCAD around 1.0350 continues to offer opportunities to go short.

Asian Currencies: Asian currencies have come in firmer dragging G-10 currencies against the USD with it. Korea doubling its current account surplus from August to September and China allowing USDRMB to fix higher for the 4th consecutive day will bring the theme of Asian currency reserves and the related allocation issues back to the market. Meanwhile, the Bank of Japan is expected to downgrade its forecasts for the country's economic growth and prices at its policy meeting today amid signs that the return of the economy to a path of sustainable expansion will be delayed due to deflation.

AUD-USD: AUD is under performing having lost 1.3% against the USD and 1.1% against EUR. A softer than expected CPI release (coming in at 0.7% q/q and 2.8% y/y) has dampened the expectations for further interest rate increases and weighed on AUD. In some ways, the CPI release has simply offset the positive impact the currency and interest rate outlook received with the above consensus PPI release earlier this week. Governor Stevens recently indicated that monetary policy would have to take into account one off shocks to terms of trade on inflation over and above the regular cyclical factors.

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

No comments:

Post a Comment