It’s been a down bound journey for the US Dollar in the distant past. After being under immense pressure in recent times the US Dollar not only witnessed its worst month since May 2009 against a basket of currencies and was caught in the currency war crossfire but an Improved Home Builder Confidence helped the dollar improved across the board following improvement in the housing market survey. All three of the HMI’s components registered gains in October. The index of current sales conditions improved by 3 points to 16, the index for sales expectations for the next 6-months rose 5 points to 23 and the index gauging traffic of prospective buyers rose 2 points to 11. The improved data gave investors an excuse to lay off the buck as it briefly put into question the extent of Fed easing.

Our analysts at World Market Pulse had already discussed the case of a positive US data triggering the Dollar Index in an earlier article. But more than the US Data, the real thrust in the US Dollar appears to come from least expected quarters after a surprise move by China raised its one year lending and deposit rates by 25 basis points. Despite a number of Fed officials indicating that the US central bank will soon embark upon further monetary stimulus for the US economy it would appear that the Chinese may have done something the Fed had been unable to do and that is to stem the tide of negative sentiment against a rapidly falling greenback. Testimony to the fact is that yesterday’s US dollar rally was the largest one day move up in the US dollar index since the 11th August, and if sustained throughout the remainder of this week could well be the start of a new phase of dollar strength.

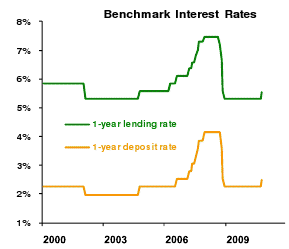

Overview Of Chinese Rate Hike: China’s central bank today raised its benchmark interest rates for the first time since December 2007, following signs the China’s economic slowdown is bottoming out in recent months. The interest rate increase comes as the economy has shown signs of rebounding from its slowdown in recent weeks, and ahead of a range of important data later this week. August retail sales quickened to 18.4% y/y, while industrial output quickened to 13.9% year/year, and both are forecast to accelerate further when September

figures are released. Lending has also been strong, with new loans raising some 596B renminbi in September.

China Benchmark Interest Rates

USD-CNY Projections: While Chinese currency appreciation may not quite match the pace of the past month going forward, analysts still forecast a gain of a little more than 1.5% per quarter, targeting a USD/CNY rate of CNY6.25 in a year’s time, or a gain of around 6.5% from current levels. Moreover China’s domestic monetary policy measures (reserve requirement increases or interest rate hike) should act as a constraint on liquidity or offer more attractive returns on renminbi funds, which should both contribute to an upwards bias for the Chinese currency.

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

No comments:

Post a Comment