Although the future of oil prices and related exchange traded funds are usually based on the basic fundamentals of demand and supply and the Crude oil prices did indeed fall after the American Petroleum Institute (API) report citing oversupply but its interesting to note that crude oil prices have been reacting more to the financial factors (such as moves in the S&P 500 index and the USD) much more as compared to the gross fundamentals of supply and demand.

Oil rose for a second straight session on Monday to top $83 as the dollar extended 15-year lows versus the yen and weakened against the euro, bolstering the appeal of commodities as an alternative investment.

Earlier, oil prices had hit a five-month peak near $83 a barrel, boosted by a slumping dollar after a BoJ rate cut and by tanker disruptions after a French strike and a closed Texan shipping route. November crude rose 1.42 percent to $82.63 per barrel, the highest settlement since closing at $86.19 on May 3rd.

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

Crude Oil VS Financial Factors

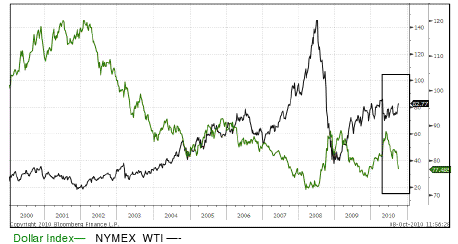

Crude oil prices are not only highly sensitive to global political and economic developments but also the US dollar as most of the worldwide oil sales are denominated in dollars. Usually when the dollar’s value declines as against the euro, effective costs in dollars increases and so does the pricing of the crude. The dollar meanwhile reached its lowest level against the euro since February as speculation grows on an impending intervention by the US Federal Reserve to boost the ailing economy.An 8% stronger S&P 500 and a 4% weaker USD could very well push oil up to USD85/bbl level as a regression on oil as a function of the S&P 500 and the USD since September 1 suggests that current equity and currency levels are compatible with USD80/bbl oil.

Comparison of NYMEX WTI and ICE Dollar Index futures,overlaid, since January 2000: (Source Bloomberg)

Oil Global Outlook:

According to the Oil Market Report released in September 2010 by The International Energy Agency (IEA), Global oil demand is projected to average 86.6 mb/d in 2010 and 87.9 mb/d in 2011. 2010 readings were revised marginally higher based on stronger data from OECD (Organization for Economic Co-operation and Development) countries. The report also projects global oil demand to grow by more than 25% in the coming 20 years:

For the short-term, investors are better off keeping an eye on market trends, geopolitical risk, credit issues while for the long-term, investors would consider the correlation with overall global growth and economic recovery, improved industrialization and growing oil demand from India and China.

Oil ETFs

United States Oil Fund (USO): The investment objective of USO is for changes in percentage terms of the units' net asset value to reflect the changes in percentage terms of the spot price of light, sweet crude oil, as measured by the changes in price of the futures contract on light, sweet crude oil traded on the New York Mercantile Exchange that is the near month contract to expire, less USO's expenses.

Expense Ratio: 0.80%

United States 12 Month Oil (USL): The investment objective of USL is to have the changes in percentage terms of the units' net asset value reflect the changes in percentage terms of the price of light, sweet crude oil, as measured by the changes in the average of the prices of 12 futures contracts on crude oil traded on the New York Mercantile Exchange

Expense Ratio: 0.86%

PowerShares DB Oil Fund (DBO): The Index is a rules-based index composed of futures contracts on Light Sweet Crude Oil (WTI) and is intended to reflect the performance of crude oil. You can't invest directly in an index.

Expense Ratio: 0.50%

The iPath S&P GSCI Crude Oil Total Return Index ETN (OIL): The index reflects the returns that are potentially available through an unleveraged investment in the West Texas Intermediate (WTI) crude oil futures contract plus the Treasury Bill rate of interest that could be earned on funds committed to the trading of the underlying contracts.

Expense Ratio: 0.75%

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

No comments:

Post a Comment