G20 Summit: As G20 heads of state meet outside Seoul South Korea from November 12-14 where President Obama is likely to be told that the Fed action was an effort to weaken the dollar to boost exports, analysts feel that most global leaders have their work cut out for on the one hand the Germans and the Chinese are complaining about the Fed's quantitative easing while the US, Canadians, Europeans are all complaining about under valued Asian currencies on the other. World Bank President Zoellich meanwhile thinks its a great time establish a new global currency agreement based to some extent on gold. The French want to orchestrate a new global accord during their reign as G20 chairman in 2011. Although President Obama is likely to stress the need for Asia, led by China, to appreciate their currencies, analysts believe that Obama will have the advantage of history over the past four decades where the US readily comes across as more of a free trading entity than the newly developed nations from which he will be receiving criticism.

Correlating Currencies and Inflation: Although the Fed appears to have succeeded in stabilizing market implied inflation expectations higher, this has been accompanied by a markedly weaker US dollar in recent times. Faced with a strong disinflationary trend, it seems that the Fed would want to keep inflationary expectations anchored at higher levels, but there are concerns that once deflationary expectations get entrenched, consumers postpone their consumption plans while businesses refrain from investing. Moreover, given the side-effect of the weaker dollar, the Fed’s strategy has run into international resistance with the G20 statement noting “advanced economies with reserve currencies” promoting excessively volatile capital flows. Meanwhile analysts at BNP Paribas believe that with an arguably stretched short USD position prone to covering, the appropriate strategy would be to shift to funding long Asian FX plays in GBP instead of the USD.

ETFs Investment Options For The US Dollar include:

PowerShares DB USD Index (UDN): The Index is a rules-based index composed solely of short USDX futures contracts. The USDX futures contract is designed to replicate the performance of being short the US Dollar against the following currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

Expense Ratio: 0.40%

PowerShares DB USD Index Bullish (UUP): The Index is a rules-based index composed solely of long USDX futures contracts. The USDX futures contract is designed to replicate the performance of being long the US Dollar against the following currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

Expense Ratio: 0.50%

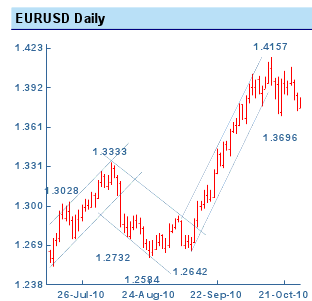

EUR: The euro weakened for a second day as concern that governments in the region will struggle to pay their debt increased before Ireland opens its books to European Union officials. Analysts at Capital Markets believe that the problems in Europe are starting to rear their ugly head again and some feel this could be just the tip of the iceberg for the euro. The euro fell 0.9 percent to $1.3905 in New York from $1.4032 on Nov. 5. It reached $1.4282 on Nov. 4, the highest since Jan. 20. It dropped as much as 1.2 percent versus Japan’s yen, matching the drop on Oct. 29, before trading at 112.85 yen, down 1 percent from 114.03 on Nov. 5.

EUR Data: Economic sentiment in the Eurozone surprised analysts in October by rising while consumer sentiment was steady at its highest level since January 2008. Industrial orders beat expectations in August with robust gains of 5.3% m/m and 24.4% y/y. The upward spike was led by capital goods that are often a barometer for rising overall orders in the coming months.

Euro ETFs To Watch Out For:

Rydex CurrencyShares Euro Currency Trust (FXE): The EUR/USD exchange rate is a foreign exchange spot rate that measures the relative values of two currencies, the euro and the U.S. dollar.

FXE Tracks: Euro Index. Expense Ratio: 0.40%

Short Euro ETFs

ProShares UltraShort Euro (EUO): ProShares UltraShort Euro seeks daily investment results, before fees and expenses, that correspond to twice (200%) the inverse (opposite) of the daily performance of the U.S. Dollar price of the Euro.

EUO Tracks: Euro (-200%) Index. Expense Ratio: 0.95%

Market Vectors-Double Short Euro ETN (DRR): As the Index is two-times leveraged, for every 1% weakening of the euro relative to the U.S. dollar, the level of the Index will generally increase by 2%, while for every 1% strengthening of the euro relative to the U.S. dollar, the Index will generally decrease by 2%.

DRR Tracks: Double Short Euro Index. Expense Ratio: 0.65%

Long Euro ETFs

ProShares Ultra Euro (ULE): ProShares Ultra Euro seeks daily investment results, before fees and expenses, that correspond to twice (200%) the U.S. Dollar price of the Euro.

ULE Tracks: Euro (200%) Index. Expense Ratio: 0.95%

Market Vectors-Double Long Euro ETN (URR): As the Index is two-times leveraged, for every 1% strengthening of the euro relative to the U.S. dollar, the level of the Index will generally increase by 2%, while for every 1% weakening of the euro relative to the U.S. dollar, the Index will generally decrease by 2%.

URR Tracks: Double Long Euro Index. Expense Ratio: 0.65%

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

World currency markets have been largely sluggish in the past week. As the November date of the FOMC draws ever nearer, there has been a wait and watch situation developing especially about the level of any stimulus especially in light of some of US Treasury Secretary Tim Geithner’s recent comments with respect to the major currency pairs.

World currency markets have been largely sluggish in the past week. As the November date of the FOMC draws ever nearer, there has been a wait and watch situation developing especially about the level of any stimulus especially in light of some of US Treasury Secretary Tim Geithner’s recent comments with respect to the major currency pairs.

The US dollar had its worst month since May 2009 against a basket of currencies when it came under pressure after the US government released its employment data last week. The U.S. durable goods orders data also forced the dollar index to fall below the key support level of 80 points over its seven month low 79.255. Such has been the pressure around the US Dollar that even better than expected GDP and jobless data have not been able to shake off the negative sentiment dragging the dollar lower.

The US dollar had its worst month since May 2009 against a basket of currencies when it came under pressure after the US government released its employment data last week. The U.S. durable goods orders data also forced the dollar index to fall below the key support level of 80 points over its seven month low 79.255. Such has been the pressure around the US Dollar that even better than expected GDP and jobless data have not been able to shake off the negative sentiment dragging the dollar lower.

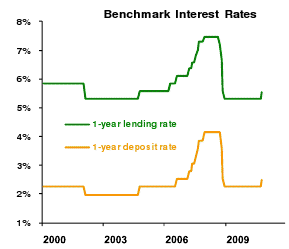

As the global economies, business and market trends change momentum towards the east, the relationship between a country's economy and its currency is getting much more complicated as governments across the globe are assuming a bigger role in propping up the financial system and encouraging economic growth. What started as a small echo with allegations on China to knowingly undervalue its currency has now grown into a currency war after the Japanese government's intervention in the currency markets by weakening the Yen for the first time in six years while the counter strike from the Dollar came when the FED announced the readiness to introduce a new round of quantitative easing to boost the economy. Such has been the impact of the recent currency games that IMF chief Dominique Strauss-Kahn has now joined those warning that governments are

As the global economies, business and market trends change momentum towards the east, the relationship between a country's economy and its currency is getting much more complicated as governments across the globe are assuming a bigger role in propping up the financial system and encouraging economic growth. What started as a small echo with allegations on China to knowingly undervalue its currency has now grown into a currency war after the Japanese government's intervention in the currency markets by weakening the Yen for the first time in six years while the counter strike from the Dollar came when the FED announced the readiness to introduce a new round of quantitative easing to boost the economy. Such has been the impact of the recent currency games that IMF chief Dominique Strauss-Kahn has now joined those warning that governments are