The US dollar had its worst month since May 2009 against a basket of currencies. In fact for the last six weeks the US dollar has slid lower relentlessly on speculation that the Federal Reserve has no choice left but to embark on a further stimulus program to liven up the flagging US economy. Forex experts are of the opinion that Fed chairman Bernanke's speech on Friday underlined the inevitability of such a move in the near future with the US dollar index despite making new 8 month lows actually finished the day higher than when it started. Friday’s move off trend line support at 76.10 from the all-time lows in March 2008 at 70.70 in the US dollar index has provoked some short covering beyond 77.00, but it would need a break above 78.00 to really get things going.

Although most experts agree that the drop in the dollar was mainly due to the Federal Reserve’s willingness to continue quantitative easing. An excess supply of dollars obviously leads to a fall in its value. Some traders attribute the dollar’s fall to the increase in risk appetite. This analysis does not ring true as the price of gold is making new highs, which actually signals risk aversion.

The movement in the dollar index has a lot of effect on commodities and other currencies, even if it does not replicate the action of the index but the USD needs some sort of a trigger mechanism to come out of its negative sluggish cycle.

EUR-USD: Friday’s late slide in the single currency and failure to close above 1.4000 suggests that we could well see a correction lower after the gains of recent weeks. A new high at 1.4155, just shy of the 1.4195 resistance soon gave way to a sharp sell-off closing below the 1.4000 level and generating a daily dark cloud cover candlestick reversal.

Some of the other potential catalysts that can act for a positive Dollar Index are dicussed here.

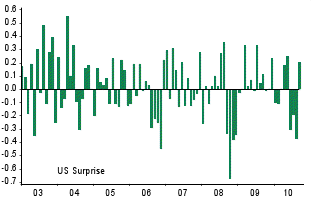

Linking Economic Data Release And USD

According to BNP Economic Research, US economists tend to react quickly to data releases. When data comes in weak, expectations are scaled back lower, increasing the chance of data exceeding expectations. Hence, the surprise indicator becomes very erratic. Hence, months of positive data surprises are often followed by a months with negative data surprises. Only, when there were severe growth deteriorations as in autumn 2006, summer 2008 and the May – July period of this year will the surprise indicator run negative readings for several months. US growth expectations have been scaled down suggesting that it will not take a lot to exceed low expectations.

ETFs Investment Options include

Rydex CurrencyShares Euro Currency Trust (FXE): The EUR/USD exchange rate is a foreign exchange spot rate that measures the relative values of two currencies, the euro and the U.S. dollar.

FXE Tracks: Euro Index. Expense Ratio: 0.40%

PowerShares DB USD Index (UDN): The Index is a rules-based index composed solely of short USDX futures contracts. The USDX futures contract is designed to replicate the performance of being short the US Dollar against the following currencies: Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

Expense Ratio: 0.40%

iPath GBP/USD Exchange Rate ETN (GBB): The GBP/USD exchange rate is a foreign exchange spot rate that measures the relative values of two currencies, the British pound and the U.S. dollar.

Expense Ratio: 0.40%

iPath EUR/USD Exchange Rate ETN (ERO): The EUR/USD exchange rate is a foreign exchange spot rate that measures the relative values of two currencies, the euro and the U.S. dollar.

Expense Ratio: 0.40%

For More World Market Pulse ETFs stocks futures commodities forex indicators forecast http://worldmarketpulse.com/

No comments:

Post a Comment